How Do You Know When an Investor is Ghosting You?

It can be a challenge to keep angel and VC investors engaged. But have you ever wondered if they’re purposely messing with you? I have.

Two years into our bootstrapped financial education startup, CentSai, my cofounder met a Chinese investor at a well-known networking event in New York City known as Empire Fintech.

The investor invited my cofounder — a consummate networker — for a breakfast meeting at the Plaza the next morning, where he was staying while scouting for potential investments on this trip. What started as a 30-minute pitch of our business resulted in a two-hour conversation.

With an enthusiasm similar to the adrenaline rush from a first date, my cofounder told me about the meeting, recounting each nuance of their encounter — and that oh, the investor mentioned he would like us to fly to China to pitch our startup at his company’s annual meeting.

We spent the next hour as detectives, scouring Google for the skinny on this investor and his company (we are journalists after all) and cross-checked anything we found. We knew he existed and his company was real.

Within 10 days, our expedited visas, airplane tickets, and our room at the Intercontinental was paid for and we were on our way to Hong Kong, the events feeling surreal.

This was a welcome departure from the soul-sucking exercise that raising capital typically was. Once, a well-known investor planned for us to pitch him in a nearby Starbucks. When it became clear that the coffeeshop was too noisy, we moved to the next logical place to hold a business meeting: the lawn and garden section in the basement of Home Depot in Midtown Manhattan.

How many times we were told we needed to be nimble, roll with the punches, and embrace constructive criticism. Yet the speed at which the China trip evolved gave us a dangerous flicker of hope.

To prepare for our adventure, our minuscule team banded together to prep — not only the business plan and projections but the pitch deck itself, each word, icon, and color carefully contemplated.

Once we landed in Hong Kong, the investor took great care to ensure we knew — with detailed emails — where to find our van straight to China’s Shenzhen province, where the company conference was being held.

We arrived in the evening at an opulent party. Sequin-clad women and men in tailored tuxes casually strolled by. Jet-lagged but giddy, we knew wealthy and high-profile investors were in the mix as entertainment continued in the background.

Nonstop evening entertainment created a party atmosphere.

The next morning we pitched our vision of CentSai in a conference room to potentially interested Chinese investors — the investor who arranged our trip stood by our side and translated our words from English to Mandarin as we spoke to the audience.

Our presentation was met with applause. We felt — and were told — we had garnered interest, by the audience’s questions and enthusiasm. Before we left the next day at breakfast in the hotel, we met a Chinese-American lawyer who lived in Brooklyn, like us.

She patiently listened to our tale and gently noted we should be careful. Doing business in China was…complicated, she warned us.

Yet once we returned Stateside, we received this promising email (names of investor and his company redacted):

There it was — in an email — this investor wanted to lead in due diligence and invest $2M in our company. He was setting a day and a time. We chalked up the comment about having more people in our office with business cards as a cultural nuance.

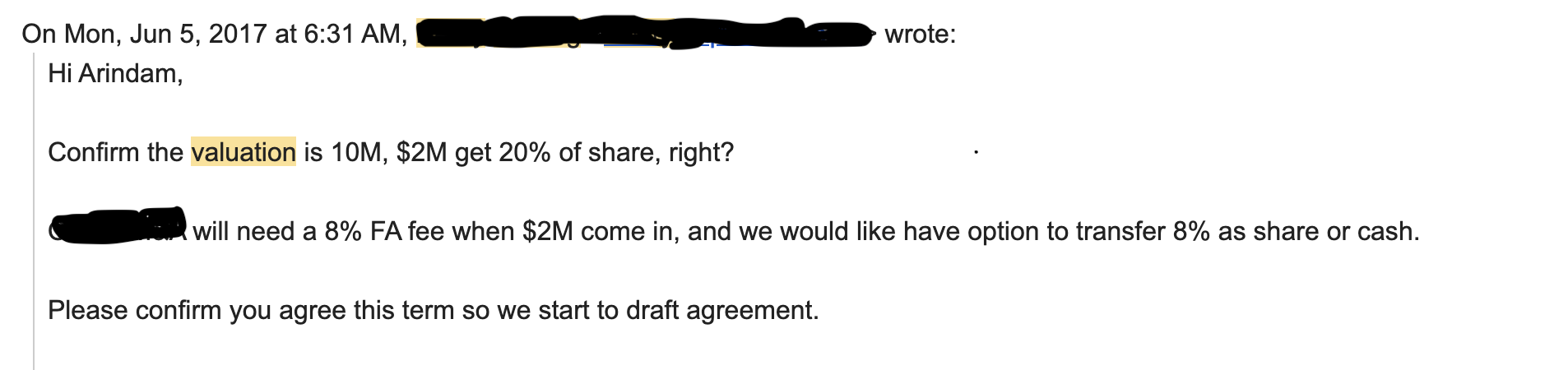

What could we possibly fear? His next email further defined the arrangement:

He was agreeing to a $10 million valuation for our nascent startup. This was our moment.

When the investor arrived at our co-working space with his boss and another colleague, neither of whom spoke English, we had our business cards ready. I faintly remember one colleague taking pictures of our team members working at their desks.

What transpired next was a three-hour session with the investor’s boss. We luckily employed an intern who spoke Mandarin. Jocelyn suddenly found herself translating between two camps. A tough grilling made sense: $2M doesn’t fall from the sky — or hadn’t for us anyway. Financial education was a tough sell in a market of sexy SaaS solutions and artificial intelligence.

After three hours, the group announced it was time to leave. They were all smiles as we took the elevator from the conference room to our floor, where they picked up their belongings.

Then they asked that the dozen or so people of CentSai stand with them and pose for a series of selfies. Our bodies smushed together as we looked into their Polaroid, all smiles. We’d hear from them soon, they said, as they took a few more shots.

We sent them a thank-you note. Nothing. We followed up the next day, and the day after, to find out when the contract would arrive.

We checked Google to ensure the investor was still alive. We felt close to him after the trip to China, his visit for due diligence, and we were flabbergasted by how he could disappear. Poof.

To this day my cofounder and I still speculate about what happened. Did the investor fail to raise the funds he himself expected and felt embarrassed? Did he start his own financial literacy company in China? We will never know.

That’s getting ghosted.